Final Expense coverage today insures less grief tomorrow.

Make one of life’s hardest moments a little easier for the people you love. Protect your family from unexpected funeral costs with affordable final expense insurance—simple coverage for peace of mind. No medical exam required and get immediate protection.

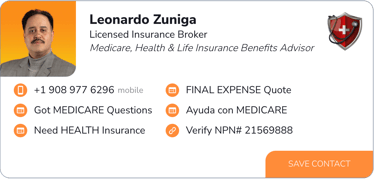

Your Licensed Advisor

Losing a loved one is never easy—and the last thing any family should worry about is how to pay for final expenses. That’s why I’m here: to help you plan ahead with care, empathy, and clarity.

As a licensed insurance agent, I specialize in Final Expense, Burial Insurance, and Legacy Protection. My mission is to provide affordable, personalized coverage that honors your wishes and relieves the financial burden on those you leave behind.

With no-pressure consultations, fast quotes, and a commitment to lifelong service, I’ll be here not just today—but for your family tomorrow, when they need support the most.

Proudly serving families with compassion, respect, and dedication.

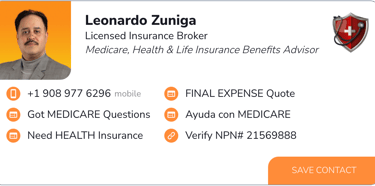

Leonardo Zuniga

Licensed Insurance Agent

76%

Families unprepared

Final Expense Coverage

Below we'll go over what is final expense, who's it for and how does it work.

Simple, Affordable Protection

Final Expense Insurance—also known as burial or funeral insurance—is a type of whole life insurance designed to help cover end-of-life costs like funeral expenses, burial or cremation, medical bills, or unpaid debts.

Who it's for?

It's most commonly used by seniors aged 50–85 who want to ease the financial burden on their loved ones. Many plans are guaranteed acceptance, even for those with health conditions.

How It Works

You choose a coverage amount (usually $5,000 to $25,000)

Pay an affordable monthly premium

When you pass away, your beneficiary receives a tax-free payment to help cover your final expenses

Why It Matters

Funerals can cost $8,000 to $12,000 or more. Final Expense Insurance ensures your family won’t have to pay out of pocket or go into debt during an already difficult time.

No Medical Exam Needed

Most plans require only a few health questions or none at all. Approval is quick—often within 24–48 hours.

$8K - $12K

Average funeral & burial costs

Key Benefits of Final Expense Insurance

Simple, lifelong protection that helps your loved ones cover final costs without added stress or financial burden.

Affordable Monthly Premiums

Final expense insurance is designed to fit almost any budget, with low, fixed monthly payments that won’t increase as you age.

No Medical Exam Required

Most plans skip the medical exam entirely—making it easy to qualify, even if you have health conditions or a complicated medical history.

Lifetime Coverage That Never Expires

As long as you keep paying your premiums, your coverage is guaranteed for life—no renewals, no surprises.

Fixed Rates That Never Go Up

Your premium is locked in from day one and will never increase, no matter how old you get or what health changes you experience.

Fast Payout to Your Beneficiary

Your loved ones receive a cash benefit—usually within days—to help cover funeral costs and other immediate expenses without financial strain.

Use Funds However Needed

The death benefit can be used for more than just funeral costs—it can also help with medical bills, credit card debt, down-payments, or anything your family needs during a difficult time.

Why Work With Us?

Compassionate agents provide personalized, no-cost consultations to establish trust and authority.

Average funeral & burial costs

We work with a variety of well-known, trusted insurance companies to help you find the right plan at the best rate available.

Licensed, Compassionate Agent

You’ll speak with a real person who’s licensed, experienced, and genuinely here to help—no pressure, just honest guidance.

No-Cost, No-Pressure Consultations

Get expert advice at absolutely no cost to you, with zero obligation to buy—just straightforward answers to your questions.

Personalized Recommendations

Every person and family is different—so we help match you with coverage that fits your unique needs, health, and budget.

Fast, Secure Process

Our process is simple, confidential, and quick—most people can get approved and protected within 24–48 hours.

We Make Complex Insurance Simple

Get expert advice at absolutely no cost to you, with zero obligation to buy—just straightforward answers to your questions.

Frequently Asked Questions

What is Final Expense Insurance?

Final Expense Insurance is a small whole life policy designed to cover funeral costs and other end-of-life expenses. It provides a tax-free payout to your loved ones to help ease the financial burden when you pass.

Can I still qualify if I have health conditions?

Yes. Even if you have health issues, you can often still qualify for coverage. Guaranteed issue policies are available for those who may not qualify elsewhere.

How much coverage can I get?

Most Final Expense policies offer coverage amounts between $2,000 and $50,000, depending on your needs and eligibility. Many people choose $10,000 to $25,000 to cover funeral and related costs.

How fast does the policy pay out?

Most Final Expense policies pay benefits within 24 to 72 hours of receiving the death certificate—helping your family handle urgent costs without delays.

Do I need a medical exam to qualify?

No medical exam is required for most plans. Many policies offer simplified or guaranteed acceptance with just a few health questions—or none at all.

What can the insurance money be used for?

The payout can be used for any purpose, including funeral or cremation expenses, medical bills, credit card debt, legal fees, or to support surviving family members.

Will my rates go up over time?

No. Once your policy is in place, your monthly premiums are locked in for life and will never increase—no matter your age or changes in health.

How long does it take to get approved?

Many people are approved the same day or within 24–48 hours after submitting a short application—especially for simplified issue policies.

What’s the difference between Final Expense and traditional life insurance?

Final Expense is more affordable and easier to qualify for, designed to cover specific end-of-life costs. Traditional life insurance typically provides higher coverage amounts and may require a medical exam.

Do I have to pay anything to get a quote or speak with someone?

Absolutely not. Quotes and consultations are 100% free with no pressure or obligation to enroll. We’re here to help you make informed decisions with confidence.

Get A Free Quote Now

Complete the form below and I'll be sure to get back to you as quickly as possible to finalize your quote & get you a sameday response.

The Coverage You Need.

The Guidance You Deserve.

Contact

info@leozuniga.com

908-977-6296

© 2025. All rights reserved.

Disclaimer: You are consenting to receive calls and text messages, including those using automated technology, from Leonardo Zuniga at the number you provided. You may withdraw your consent at any time by replying STOP. You information will never be share or sold.

LEONARDO ZUNIGA

NPN# 21569888

Hablamos Español